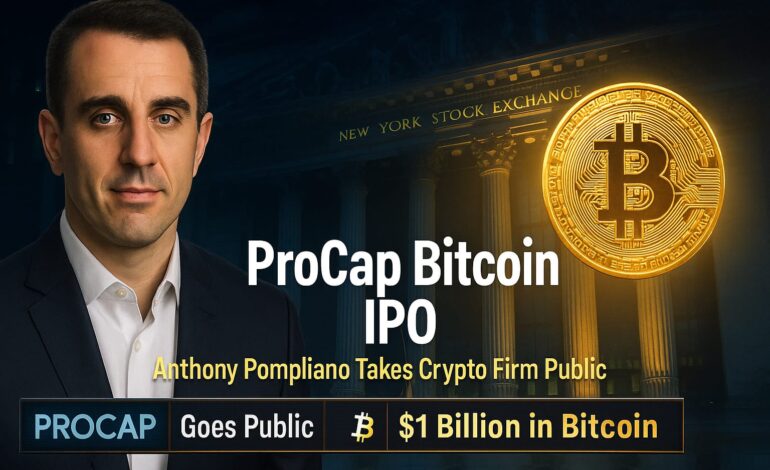

ProCap to Go Public With $1B in Bitcoin Holdings

ProCap to Go Public – Prominent crypto investor Anthony Pompliano is taking his firm ProCap Financial public through a $750 million merger with Columbus Circle Capital Corp, a blank-check company. Once the deal closes, the new public entity—ProCap Financial Inc.—will hold a staggering $1 billion worth of Bitcoin (BTC) on its balance sheet.

The SPAC merger is expected to finalize before the end of 2025, positioning ProCap as a major new player among publicly traded Bitcoin-holding companies.

Pompliano’s Vision: Bitcoin-Focused Financial Powerhouse

“ProCap Financial will focus on acquiring bitcoin for its balance sheet, while also developing products and services to produce revenue and profit from the bitcoin on our balance sheet over time,” said Pompliano on X (formerly Twitter).

Pompliano will lead the new public company after the merger.

$750M Raised to Fund the DealPompliano will lead the new public company after the merger.

The companies confirmed they have raised over $750 million to fund the transaction:

- $516.5 million in equity capital

- $235 million through convertible notes

Backers of the raise include:

- FalconX, a leading crypto brokerage

- Blockchain.com, a major crypto financial services firm

- Eric Semler, chair of Bitcoin-holding firm Semler Scientific

ProCap to Join the Elite Bitcoin Balance Sheet Club

With $1 billion in BTC planned for its balance sheet, ProCap would rank 8th among all public companies holding Bitcoin, surpassing Coinbase, which currently holds 9,267 BTC (~$974 million).

The move puts ProCap in league with other major BTC-holding companies like:

- MicroStrategy (formerly Strategy), which holds 592,345 BTC (~$62.3 billion)

- Trump Media, which plans to buy $2.5 billion in Bitcoin

This trend of crypto-rich balance sheets signals the growing adoption of Bitcoin as a strategic asset by corporations.

Crypto IPO Wave Accelerates

ProCap is not alone in chasing Wall Street exposure. Several other crypto-related companies are also eyeing public listings:

- Twenty One Capital, led by Strike’s Jack Mallers, is merging with Cantor Equity Partners via SPAC

- Tron, founded by Justin Sun, plans a reverse merger with SRM Entertainment, investing $210 million into the TRX token

- Circle, issuer of USDC, went public on June 5, and its stock has surged over 670%

This surge of crypto IPOs marks a broader trend of crypto-mainstream convergence, attracting institutional and retail investors alike.

What It Means for the Market?

As companies like ProCap push Bitcoin deeper into public markets, it strengthens the institutional foundation for BTC. Investors now have more options to gain crypto exposure through regulated, public vehicles—without directly holding tokens.

Pompliano’s ProCap move could further legitimize Bitcoin’s role as a treasury asset and spark more crypto-native firms to follow suit.

Also Read : Bitcoin Falls Below $100K as US–Iran Tensions Rattle Markets