Student Loan Shake-Up: New IBR Rule Lets More Borrowers Qualify

Student Loan Shake-Up: The U.S. Department of Education is preparing one of the most significant shifts to federal student loan repayment in years, as it finalizes updates to the Income-Based Repayment (IBR) program. Under the new rules advanced through President Donald Trump’s recently passed fiscal legislation borrowers will no longer be required to prove a “partial financial hardship” to qualify for IBR.

This change dramatically widens eligibility, allowing even higher-income borrowers to enroll and potentially reduce their monthly payments. Until now, applicants had to demonstrate that their income level made repayment difficult, causing many to be denied. The Department has instructed loan servicers to place applications that would previously have been rejected “on hold” until the update is fully implemented.

Financial literacy instructor Alex Beene told Newsweek that eliminating the hardship requirement will significantly expand access: “Many additional borrowers will now potentially qualify for the plan,” he said, noting that payments under IBR are tied to 10 -15 percent of discretionary income. Remaining balances continue to be forgiven after 20 or 25 years, depending on the loan date.

The update comes alongside sweeping changes across the federal student loan system. Trump’s fiscal package eliminates the Biden-era SAVE plan and will phase out the Income-Contingent Repayment (ICR) and Pay As You Earn (PAYE) plans by July 2028 programs currently used by an estimated 2.5 million borrowers. In their place, the Repayment Assistance Plan (RAP) will launch in July 2026, offering the lowest monthly bills but extending forgiveness timelines to 30 years.

At the same time, the administration has capped federal loan amounts for undergraduates and ended the GRAD PLUS program. Only students pursuing “professional degrees” will be eligible to borrow up to $50,000 per year part of a broader effort to curb rising tuition costs. Education Secretary Linda McMahon defended the decision, arguing that unlimited borrowing encouraged institutions to raise prices unchecked.

But the rule changes are not limited to repayment structures. Revised guidance also tightens which employers qualify for the Public Service Loan Forgiveness (PSLF) program. Nonprofit and public service organizations deemed to have a “substantial illegal purpose” including those participating in services related to undocumented immigrants or transgender youth may no longer count toward PSLF employment requirements.

Financial experts warn that while monthly bills may drop for many, full loan forgiveness may take significantly longer under the new system. “Borrowers will be nudged into RAP,” said Kevin Thompson, CEO of 9i Capital Group. “Thirty-year forgiveness timelines will become more common.”

Even as eligibility broadens, Beene cautioned borrowers not to misuse income-driven repayment options: “If you can afford to pay more, it’s smarter long-term to pay the debt off quickly.”

The Department of Education expects the updated IBR rules to be fully implemented by December 2025, marking a major turning point in federal student loan policy.

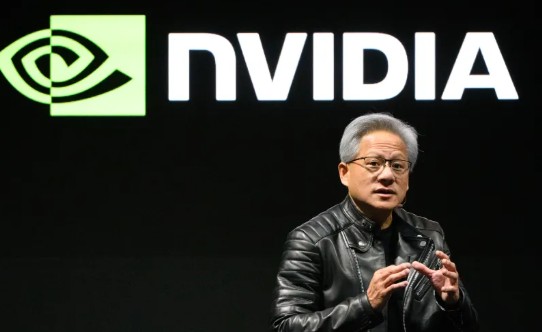

ALSO READ – Nvidia Invests $2 Billion in Synopsys to Supercharge AI Engineering in Major New Partnership