How RegTech Is Saving American Businesses Billions and Making Compliance Cool

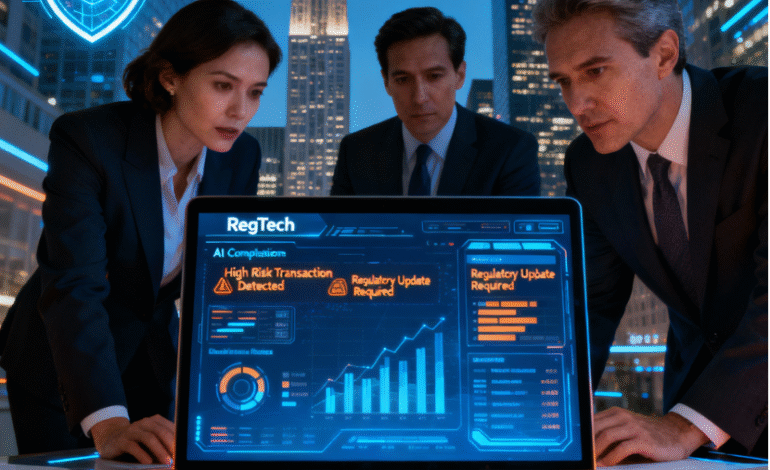

RegTech Is Saving American Businesses: Regulatory Technology- better known as RegTech is transforming how America’s banks, fintechs, insurers, and even healthcare organizations navigate the rising tide of rules, audits, and risk. But what is RegTech, why does it matter, and how will it shape the future of compliance?

What Is RegTech?

RegTech stands for Regulatory Technology: software and data-driven platforms designed to automate, streamline, and strengthen regulatory compliance. If you’re imagining the endless paperwork and constant regulatory headaches that come with financial services, RegTech is the answer. These solutions harness artificial intelligence, machine learning, big data analytics, and cloud computing to digitize compliance—think instant reporting, automated monitoring, and seamless fraud detection.

How Does RegTech Work?

RegTech tools perform tasks like:

- Customer identity verification (KYC)

- Transaction monitoring for fraud/AML

- Automated regulatory reporting

- Risk scoring and predictive analytics

- Privacy regulation enforcement (like GDPR, CCPA)

These platforms connect to a business’s existing systems and scour vast volumes of data to flag suspicious activity, auto-fill required reports, and keep up with constantly changing laws in real time.

Benefits: Why Are American Firms Embracing RegTech?

1. Automation & Efficiency: RegTech greatly reduces manual work, automating repetitive, error-prone compliance tasks, and freeing up valuable staff time.

2. Cost Savings: Fast onboarding, automated reporting, and fewer errors mean lower operational costs and less need for hiring armies of compliance staff.

3. Real-Time Risk Reduction & Fraud Prevention: Advanced analytics and AI allow for dynamic monitoring catching threats before they become fines or scandals.

4. Greater Accuracy & Transparency: RegTech tracks every rule change (a new regulatory update emerges every 7 minutes globally!), helping firms avoid costly mistakes and maintain audit-ready documentation.

5. Scalability: Cloud-native platforms adapt to changing laws and growing businesses, helping even small or hybrid teams stay compliant.

Real-World Applications

- Banks use RegTech for anti-money laundering monitoring and automated suspicious activity reports.

- Insurers rely on it for regulatory reporting and privacy compliance.

- Healthcare firms use RegTech tools for HIPAA or patient data protection.

- Almost any highly regulated business benefits from automated compliance workflows and real-time regulatory alerts.

Cons and Open Challenges

1. Implementation Costs & Complexity: Building RegTech into old systems can be tricky and costly upfront especially for smaller firms.

2. Cybersecurity Risks: Connecting sensitive data to the cloud and third-party vendors requires strong encryption and privacy practices, which is an ongoing challenge.

3. Constant Change: Regulations are always evolving. Some RegTech tools may struggle to keep pace or may miss nuances in local/state rules.

4. Change Management: Staff need to be trained, and old processes phased out. This transition sometimes faces resistance from teams used to manual workflows.

Future of RegTech: What’s Next?

The global RegTech market is exploding set to reach over $60 billion by 2030 as every major regulator and financial institution pursues digital transformation. U.S. regulators increasingly expect companies to be audit-ready in real-time, while cloud-native solutions, automated privacy tools, and AI-driven oversight make compliance smart and proactive not just a cost of doing business. As financial crime becomes more sophisticated, RegTech promises precision, speed, and security.

In coming years, expect RegTech to:

- Power instant, cross-border compliance for global firms

- Integrate seamlessly with major platforms—banking, insurance, payroll, even e-commerce

- Help agencies identify market risks faster, benefiting both consumers and institutions

- Bring compliance closer to “set and forget,” freeing leaders to focus on growth

RegTech isn’t just another buzzword- it’s how American businesses are meeting the complexity of modern regulation head-on. Whether you’re a startup, bank, or multinational, savvy use of RegTech is quickly becoming essential for staying compliant, saving money, and keeping customers’ trust in a rapidly changing world.

ALSO READ – Buy Now, Pay Later Surges in 2025: What U.S. Consumers Need to Know About Flexible Payments