What Is a Neobank? Top Neobanks in 2025, Features and Benefits

Top Neobanks in 2025: A neobank is a digital-first financial institution delivering core banking services entirely online via mobile apps and web platforms, with no physical branches. These challenger banks provide savings accounts, checking accounts, transfers, loans, and payment solutions—all accessed through intuitive digital interfaces.

Unlike traditional banks, neobanks focus on simplicity and speed, allowing users to open an account, transfer funds, and access tools for budgeting and analytics in minutes from their smartphones or laptops.

How Neobanks Differ from Traditional Banks

- No physical branches: All banking is conducted in-app or online, reducing costs and passing those savings to customers.

- Fast onboarding: Account creation can take minutes, often with automated identity verification.

- Technology-first: Apps leverage AI, machine learning, and data analytics for personalized insights, automated budgeting, and security features.

- Transparent pricing: Neobanks usually offer fee-free or low-fee services, with easy-to-understand terms and few hidden charges.

- Alternative credit and financial tools: Many neobanks give access to credit-building, overdraft protection, and early paychecks, expanding inclusion for “credit invisible” populations.

Key Features of Neobanks

- Advanced mobile apps: From instant deposits to check capture by phone camera, all services are accessible from smartphones.

- Real-time alerts and analytics: Users receive transaction alerts, spending breakdowns, budget recommendations, and financial health insights, all personalized by AI.

- High-yield savings: Competitive interest rates on deposits, often beating traditional banks.

- Cash management and rewards: Combined savings-checking-investment accounts with cashback and rewards programs.

- Rapid transfers: Instant peer-to-peer and account-to-account transfers, including remittances in multiple currencies.

- Security: FDIC insurance, fraud alerts, biometric login, and encrypted platforms maintain user protection.

- Embedded finance: Integration with retailer apps, bill pay, and subscription management allows seamless money movement.

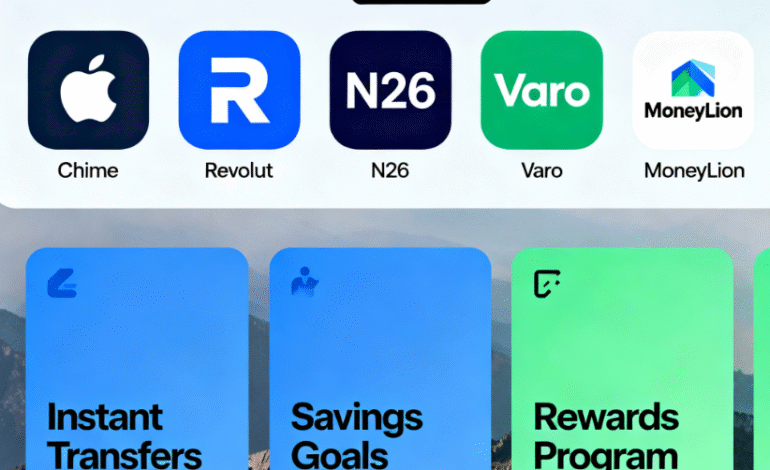

Top Neobanks in 2025

- Chime: Fee-free US banking, credit builder tools, and early direct deposit.

- Revolut: All-in-one banking, investing, global currency exchange.

- N26: Mobile-first, strong European reach, smart budgeting.

- Varo, MoneyLion, Current: High-yield savings, cash advances, tailored rewards for American users.

- NuBank: Latin American leader with credit-friendly, user-first model.

Benefits of Neobanks

- Convenience: Manage all finances digitally, anytime, anywhere.

- Low fees & high rates: Digital efficiency allows neobanks to offer competitive interest rates and nearly zero fees.

- Financial inclusion: Easier access for consumers overlooked by traditional banks, with mobile-first apps and credit alternatives.

- Personalization: Data-driven analytics and AI deliver tailored advice, saving tips, and custom financial insights.

- Innovation: Regular updates, new features, and rapid adaptation driven by competition in fintech.

Limitations and Risks

- Not all neobanks offer full product ranges seen with traditional banks—mortgages and broad investment options may be limited.

- Profitability is a challenge for many neobanks, with sustainability hinging on innovative business models and diversification.

- Some online-only banks partner with traditional banks for FDIC insurance or regulatory coverage, meaning users should always check security credentials.

The Future of Neobanking

Global adoption is set to pass 850 million users by 2030, with neobank market value projected to exceed $1 trillion. Personalization, embedded financial services, advanced security, and sustainable digital models are shaping the competitive landscape. As neobanks expand internationally and traditional banks race to modernize, digital-first banking will continue to redefine the way people manage their money.

Neobanks are revolutionizing banking for a digitally native generation, offering efficiency, accessibility, and customization that traditional institutions increasingly seek to emulate.

ALSO READ – Buy Now, Pay Later Surges in 2025: What U.S. Consumers Need to Know About Flexible Payments