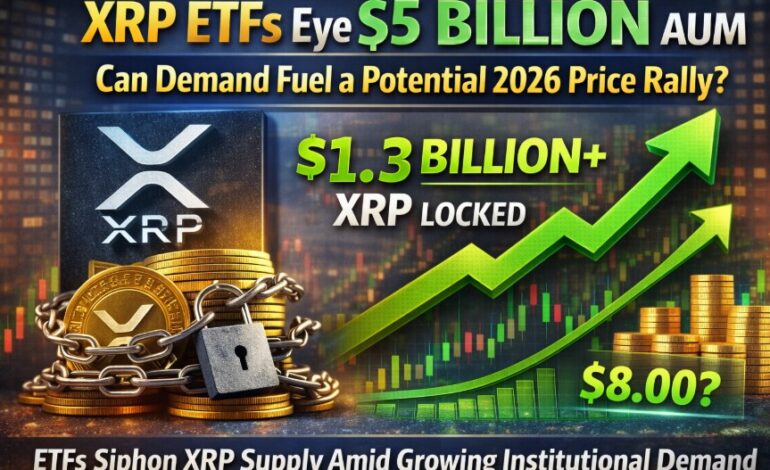

XRP Price Outlook 2026: ETFs Siphon Supply, Analysts Eye $5–$8 Targets

XRP Price Outlook 2026: XRP exchange-traded funds (ETFs) are rapidly emerging as one of the most significant forces influencing the token’s future price trajectory, as institutional interest and capital inflows reshape supply dynamics and investor expectations.

Since their launch in late 2025, XRP-linked spot ETFs have attracted more than $1.3 billion in institutional inflows within approximately 50 days, locking up roughly 746 million XRP (about 1.14% of the circulating supply) in custody. This sustained demand is notable for its consistency: XRP ETFs have recorded dozens of consecutive inflow days with minimal net outflows.

Supply Tightening and Exchange Balances Hit Multi-Year Lows

According to market data, XRP’s exchange-held token balances have fallen sharply, approaching the lowest levels seen in nearly eight years. As of early 2026, exchange reserves have dwindled to around 1.6 billion tokens, down significantly from higher levels in 2025 a drop that both reflects and reinforces the supply shortage on trading venues.

Reduced exchange liquidity typically signals accumulation rather than selling, as tokens are removed from active trading and absorbed by long-term holders or institutional vehicles. Analysts argue that this tightening could lessen sell pressure and support price strength if ETF demand continues to grow.

Price Performance Lagging Despite Institutional Flows

Despite the impressive ETF inflows, XRP’s price performance has remained somewhat subdued. As of early January 2026, XRP has been trading near key support levels around $1.85–$2.00, failing to make a decisive breakout. Market sentiment indicators suggest mixed momentum, with demand drivers from ETFs contrasting ongoing selling pressure in retail segments.

Crypto sentiment metrics show bearish commentary and fear index readings elevated in recent days, pointing to uncertain near-term price action. However, some analysts maintain that the presence of institutional demand at least provides a structural floor under the asset.

What Happens If ETF Assets Hit $5 Billion?

Experts forecast that if XRP ETFs continue attracting capital at the current pace — estimated at roughly **$25–$30 million inflows per day total ETF assets under management could reach as much as $5 billion by mid-2026. If that milestone is reached, the total XRP tokens locked up might exceed 2.6 billion tokens, or about 4% of the circulating supply.

Reducing available supply while institutional demand grows would create a classic scenario of structural scarcity a dynamic that has historically supported upward price moves in assets like Bitcoin following ETF adoption.

Long-Term Price Predictions and Market Sentiment

Several institutions and analysts have weighed in on XRP’s potential long-term price levels. Standard Chartered, for example, reiterated views that XRP could reach as high as $8 by the end of 2026, assuming strong institutional flows and continued regulatory clarity around spot ETF structures.

Other commentators are even more bullish, suggesting that prices could potentially climb into the $6–$10 range by 2026 if ETF momentum continues and broader adoption grows.

Nevertheless, some analysts caution that ETFs alone do not guarantee immediate price spikes — institutional inflows must sufficiently pull real supply off exchanges faster than tokens are reintroduced through selling or other market activity.

What Investors Are Watching Next

Going forward, market participants will be watching:

• Whether XRP ETFs can exceed the $1 billion and ultimately $5 billion AUM thresholds.

• Continued decline in exchange reserves, which may heighten the supply squeeze.

• Broader institutional adoption through regulated investment products.

• Key technical price levels above $2.20–$2.50, which traders view as crucial breakout zones.

The interplay between institutional capital flows, on-chain dynamics, and broader market sentiment is likely to shape XRP’s price story in 2026 making this year a potentially pivotal one for holders and newcomers alike.

ALSO READ – Chevron Stock Price Climbs with Near-Term Catalysts- What Investors Should Know